An attractive investment option, gold has been the favourite of investors all over the world. In simple words, gold investing can be explained as the process of buying gold and storing it to avail of its benefits later on when its value increases. Unlike stocks or real estate, gold is considered safer and better as a long-term investment. Listed below are some other favourable qualities which make gold such a lucrative option for investment.

- Gold is certainly the easiest asset to invest in. One does not need to have experience in making investments to buy gold. The option to buy gold certificates, gold coins and mutual funds specifically related to gold makes it a rather simple and easy choice for first-time investors as well.

- Liquidity, or the ease to turn your gold into money, is another quality that attracts investors, both novice and experienced. Whenever you need cash all you need to do is find a buyer and sell the gold.

- The value of gold is sure to be stable or increase over time. Even if the cost of currency decreases, it does not affect the value of gold much. This is not the case with currency and this happens because unlike currency the amount of gold present all over the world is limited.

- Security against inflation is another prominent reason why gold is considered a better investment. It is seen that the value of gold increases when inflation occurs. As it stays unaffected from the effects of inflation, gold proves to be a more stable and safer investment option as compared to cash.

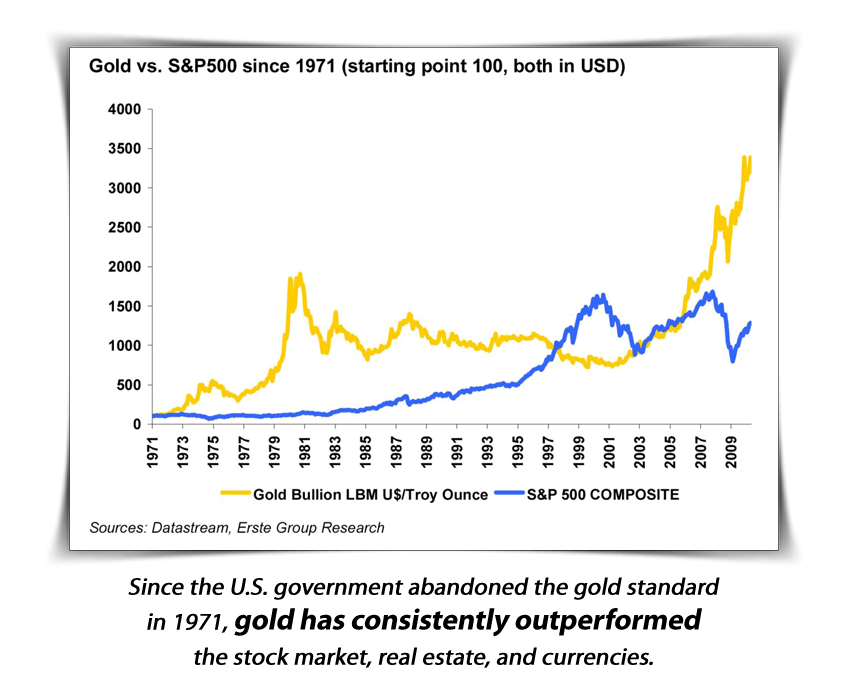

- If diversifying your investment portfolio is necessary for you then make sure to invest in gold as well. Not only that, but the overall risk is also lowered when you make gold investment. It is also worth mentioning that gold is inversely related to currency value and stock market, which makes it an effective way of diversifying.

- The demand for gold is constant, as apart from jewellery it is used for making a variety of products, such as electronics and gadgets. This reliable demand is a major reason accredited for stabilising the cost of gold. On top of that, increasing demand for gold also results in its higher price.

- Universal demand for gold is what makes it so popular all over the world. While the scope of investments, like real estate, stocks and currency, is limited, gold is accepted universally, providing investors the choice of buying and selling it anywhere in the world.

If all other investment options seem too risky or complicated to you, then opt for gold. Safe from the effects of inflation or political chaos, adding gold to investment portfolio can also benefit you in many ways. At the same time you should adopt a careful approach when investing in gold, as one should avoid limiting his portfolio to just one asset class. Thus, it is suggested to diligently research and understand different options available before gold investing and choose the ones which suit your preference and purpose.